Proper Planning

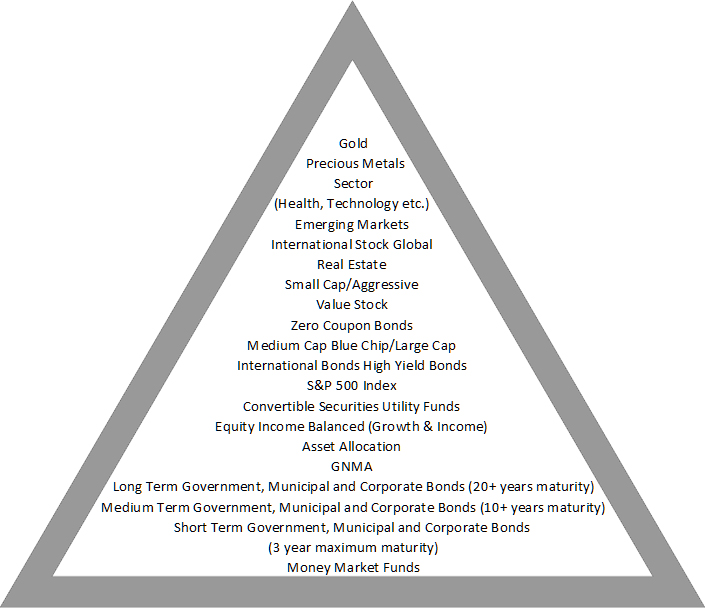

The foundation for investing starts with proper financial planning; setting goals, establishing a budget, gathering financial records and knowing your net worth. The financial planning process starts with gathering information. For the financial planner to do his or her job, that person must know your present financial structure, your goals and risk tolerance. The more knowledge that can be obtained the better the financial planner can do his or her job. It is suggested you print and complete the client questionnaire then fax or mail it to our office.